tax shield formula excel

This reduces the tax it needs to pay by 280000. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Earnings Before Interest After Taxes Ebiat Formula And Calculation

.

. This is usually the deduction multiplied by the tax rate. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense. Depreciation Tax Shield Formula Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

This is equivalent to the 800000 interest expense multiplied by 35. Fixed Assets for CCA 990000 4. Free Case Review Begin Online.

Tax shield formula excel. 1-046 24 1-046 25 of between 24 and 25 pre-tax. For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. In the line for the initial cost and salvage value NCS the salvage value should have a negative sign negative spending. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation expense.

Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note. View Tax-Shield-Formula-Excel-Templatexlsx from AC 405 at The University of Tokyo. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Ad Based On Circumstances You May Already Qualify For Tax Relief.

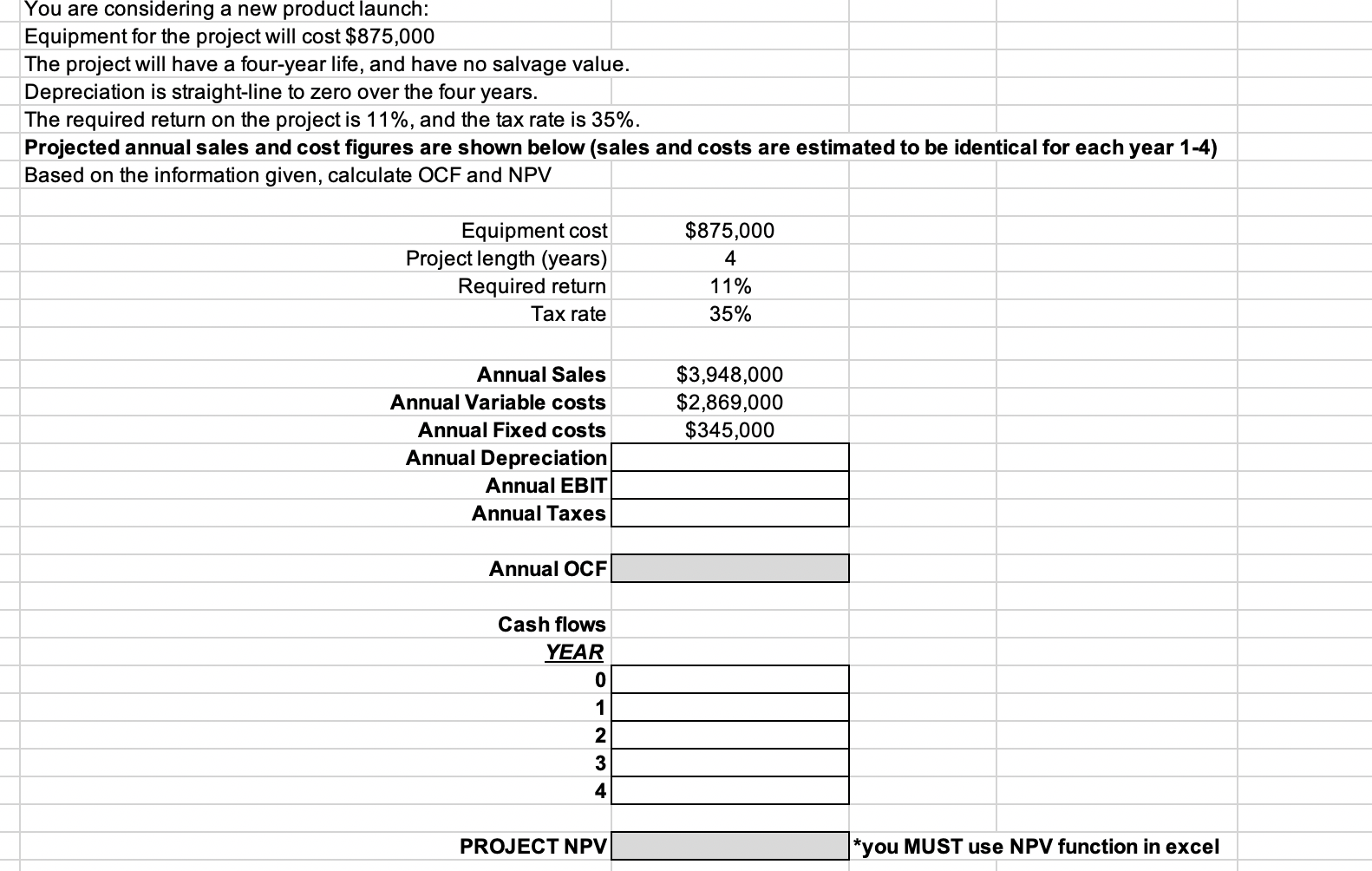

Yearly incremental CFs Sales 1060000 -100000 960000 Costs 500000 Total after tax 960000 - 5000001-40 276000 3. Depreciation tax shield formula examples how to calculate with example step by calculation template free excel annual equation tessshlo cash flow after deprecition and 2 you definition does it works income taxes in capital budgeting decisions appendix 8 Depreciation Tax Shield Formula Examples How To Calculate Depreciation Tax Shield Formula Examples How. Tax Shield 10000 40 100 Tax Shield 4000.

Additional negative sign in the formula CFFA OCF -. As such the shield is 8000000 x 10 x 35 280000. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒.

The expression CI CO D in the first equation represents the taxable income which when. Interest Tax Shield Interest Expense Tax Rate. As such the shield is 8000000 x 10 x 35 280000.

Integrated Example 1. The effect of a tax shield can be determined using a formula. .

The remaining asset value at the end of its useful life from the assets purchase price which is subsequently divided by the estimated useful life of the fixed asset. The value of these shields depends on the effective tax rate for the corporation or individual. These two equations are essentially the same.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. CF CI CO CI CO D t.

Tax Shield Deduction x Tax Rate. See If You Qualify For IRS Fresh Start Program. Initial Investment Fixed Assets 900000 90000 990000 Working Capital 3000027200-10000 47200 Total -990000-47200 -1037200 2.

In this video on Tax Shield we are going to learn what is tax shield. Sum of Tax Deductible Expenses 10000. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

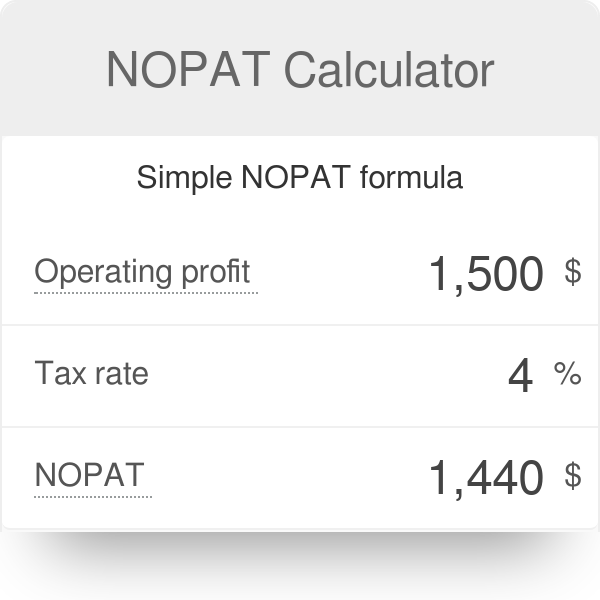

Nopat Calculator Nopat Calculation Nopat Formula

How To Control Your Credit Score 4 Ways To Boost Your Credit Score Your Credit Score Is Credit Repair Companies Credit Repair Business Credit Score Infographic

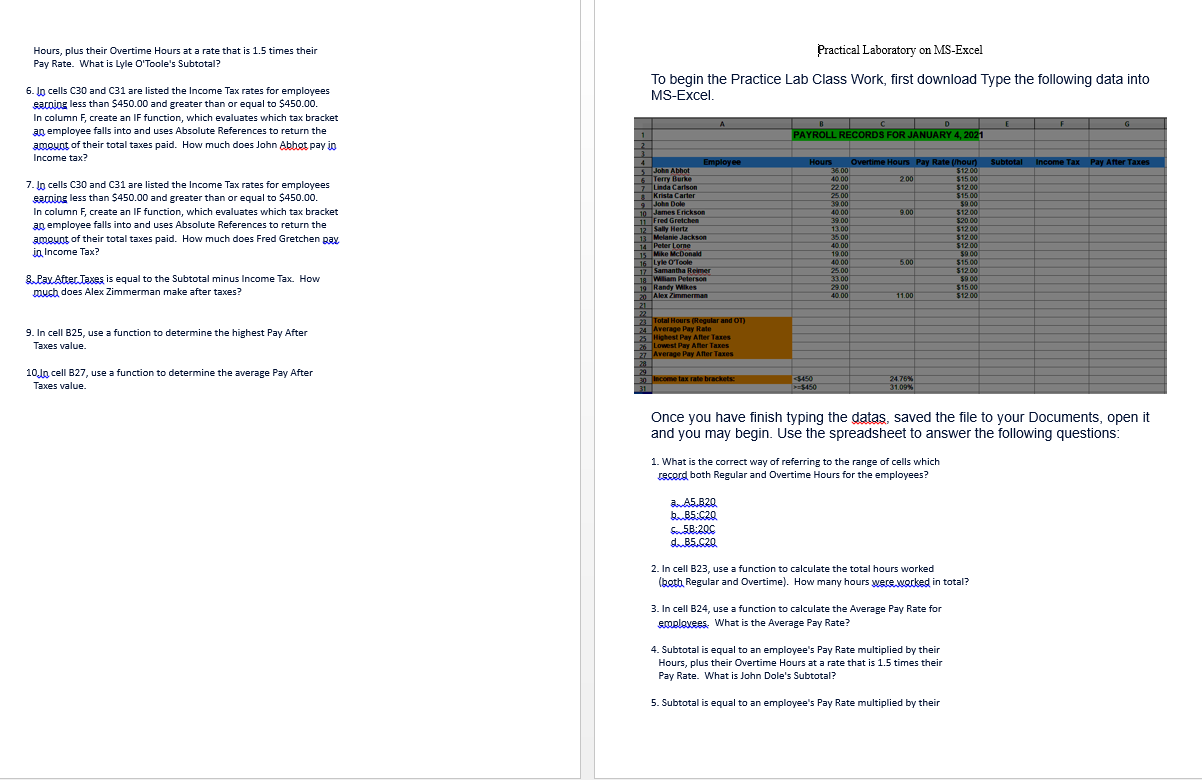

Solved Practical Laboratory On Ms Excel Hours Plus Their Chegg Com

Return On Equity Roe Formula Examples And Guide To Roe

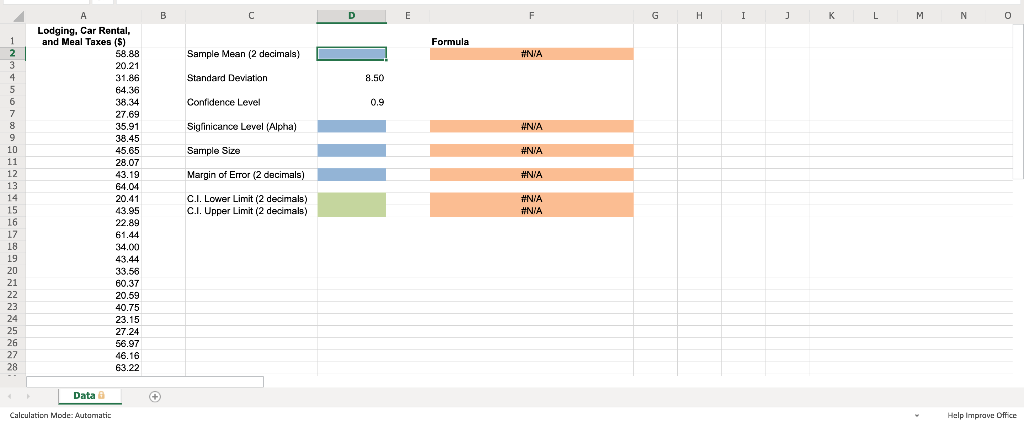

Solved In An Attempt To Assess Total Daily Travel Taxes In Chegg Com

Unlevered Free Cash Flow Definition Examples Formula

Ebit Formula And Operating Income Calculator Excel Template

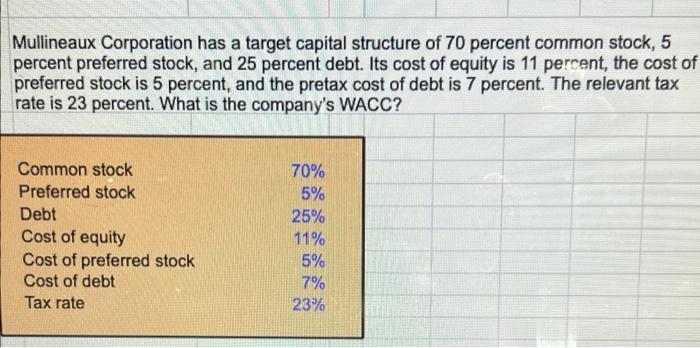

Solved Mullineaux Corporation Has A Target Capital Structure Chegg Com

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

How To Calculate The Total Cost Of Quantity With Price Breaks In Excel Quora

Weighted Average Cost Of Capital Wacc Formula And Calculation

Solved Answer Yellow Sections Only And Answers Must Chegg Com

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Calculator

Relative Standard Deviation Formula Rsd Calculator Excel Template

Bond Yield Formula And Calculator Excel Template